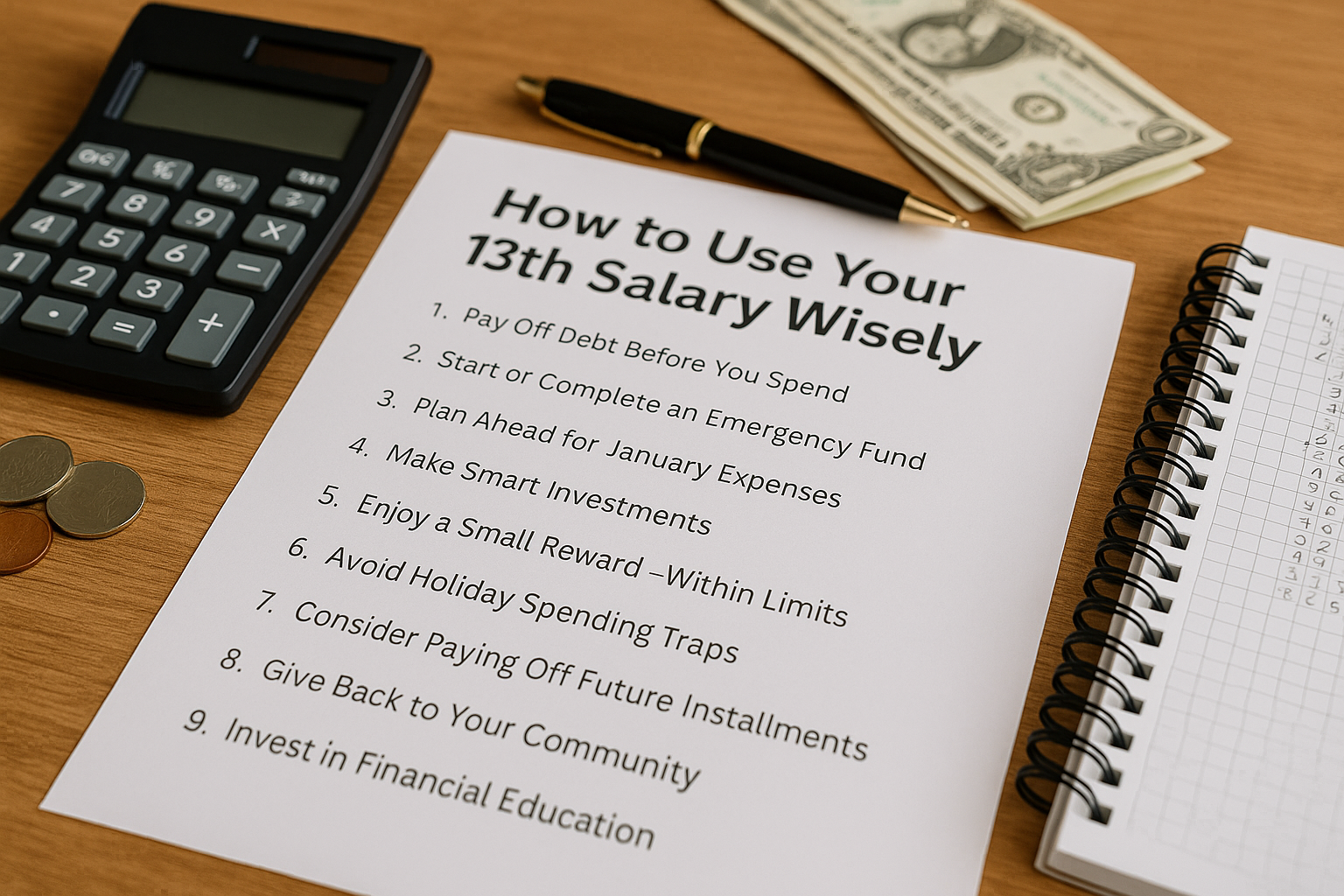

The 13th salary, or end-of-year bonus, can be a powerful tool to boost your finances—if used with intention. Many people spend it quickly on holiday shopping or unnecessary items, missing the chance to make meaningful financial progress.

If you want to get ahead instead of falling into the same year-end spending cycle, here are smart, practical ways to make your 13th salary work for you.

Pay Off Debt Before You Spend

Before thinking about shopping or travel, look at your debts. Do you have credit card balances or overdue payments? These usually come with high interest rates that grow every month.

Using your bonus to eliminate or reduce debt brings instant relief and improves your financial stability. It also means you’ll start the new year with less pressure on your income.

Start or Complete an Emergency Fund

Emergencies are part of life—but they’re much easier to handle when you’re financially prepared. If you don’t have a safety net yet, your 13th salary is the perfect way to start one.

A good emergency fund should cover three to six months of essential expenses. Store the money in a secure, low-risk account with quick access, such as a high-yield savings account or government bond.

Plan Ahead for January Expenses

The beginning of the year often comes with big bills—like school fees, insurance renewals, and property taxes. Many people use credit to cover them and end up paying interest unnecessarily.

Use your 13th salary to cover these costs in advance. You’ll avoid financial stress and maybe even receive discounts for paying early.

Make Smart Investments

If your debts are under control and your emergency fund is covered, investing is the next smart step. You don’t need a huge amount to get started. Even small investments can grow significantly over time.

Look into beginner-friendly options like:

- Treasury bonds

- Fixed-income funds

- ETFs or index funds

- Robo-advisors

Choose the option that matches your goals and risk tolerance.

Enjoy a Small Reward—Within Limits

You deserve to enjoy your hard work. Set aside a small portion of your bonus—perhaps 10% to 20%—for something that brings you joy.

Whether it’s a weekend getaway, new clothes, or a nice dinner, the key is moderation. Spending a small amount intentionally is very different from using the entire bonus without a plan.

Avoid Holiday Spending Traps

The end of the year is full of temptation. Discounts, ads, and “limited-time offers” encourage quick purchases that you may later regret.

To stay in control, create a spending plan. List what you truly need, set a budget, and avoid emotional shopping. Being intentional with your money helps prevent overspending.

Consider Paying Off Future Installments

If you’ve already made purchases in installments, check if you can pay off a few of them early. In some cases, this brings discounts or reduces your interest costs.

By doing this, you free up part of your income for future months—and that helps your long-term planning.

Give Back to Your Community

Using a small part of your 13th salary to help others is a meaningful and responsible choice. Whether it’s a charity, a local project, or someone close to you in need, small gestures can make a big impact.

It also brings a sense of purpose and appreciation for what you have.

Invest in Financial Education

Improving your money skills pays off for the rest of your life. Use part of your bonus to buy a personal finance book, take an online course, or attend a financial workshop.

The knowledge you gain will help you make better decisions and grow your money with confidence.

Create a Spending Plan in Advance

Don’t wait until the bonus hits your account to decide what to do. Make your plan now—before the money arrives.

Here’s a simple example:

- 40% for debt repayment

- 30% for savings or investments

- 20% for January expenses

- 10% for fun

This approach helps you avoid waste and use your 13th salary to truly improve your life.

Your Bonus, Your Opportunity

The 13th salary is not just extra cash—it’s a powerful opportunity. Used wisely, it can help you reduce stress, reach your goals, and feel more in control of your financial life.

Instead of spending it quickly and forgetting it, treat your bonus like a tool for growth. With a plan in place, it can make a lasting difference.