Compound interest is often described as the eighth wonder of the world — and for good reason. It’s one of the most powerful financial forces available to you. Whether you’re saving, investing, or trying to grow your wealth over time, understanding how compound interest works can completely transform your approach to money.

What Is Compound Interest?

Compound interest is the interest you earn on both your original money (principal) and on the interest that has already been added to it.

In other words, you’re earning interest on interest.

This causes your money to grow faster over time compared to simple interest, where you only earn interest on the principal.

The Formula for Compound Interest

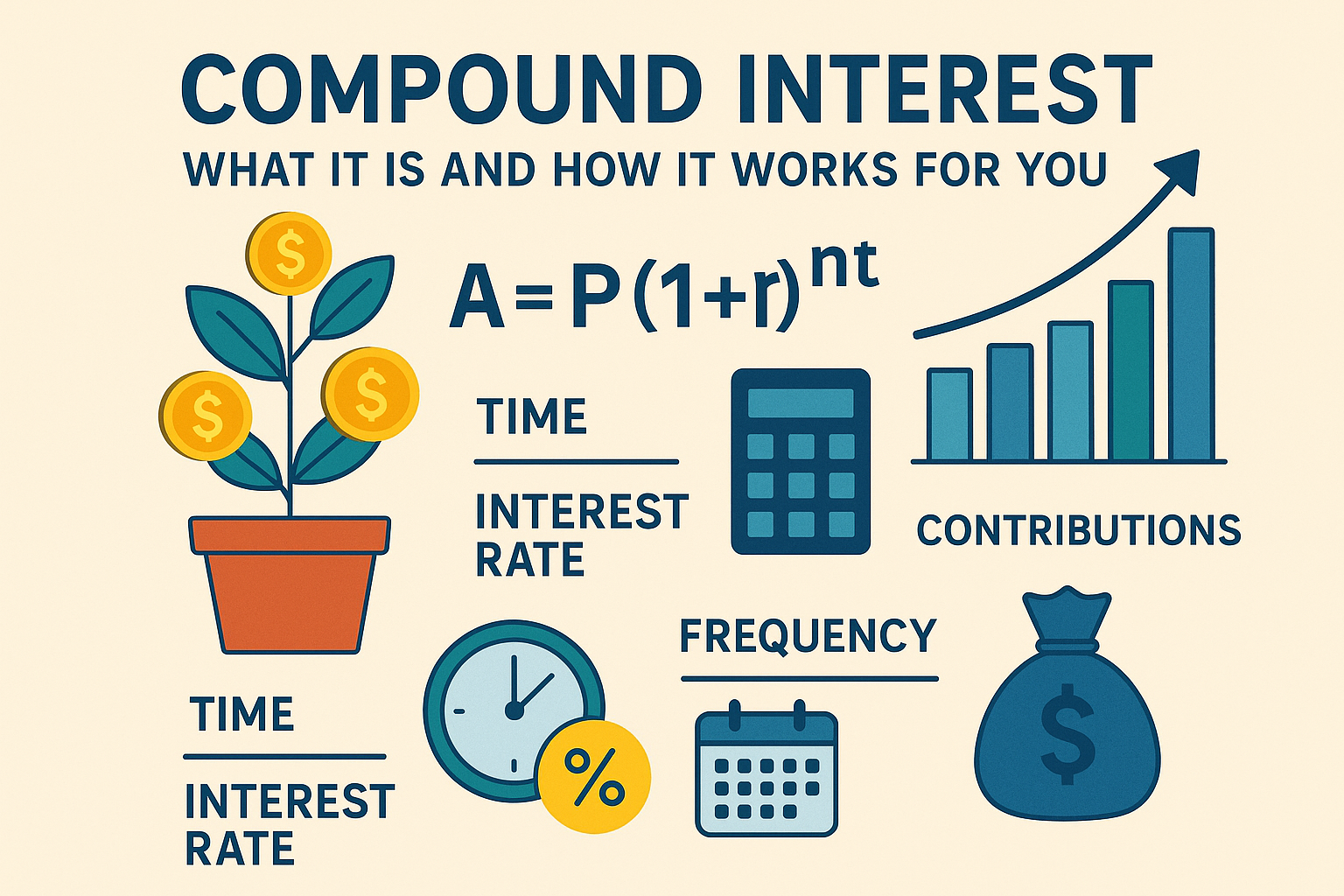

While you don’t need to memorize complex math, knowing the basic formula can help you understand how different factors affect your returns:

A = P (1 + r/n)^(nt)

Where:

- A = the amount of money accumulated after n years, including interest

- P = principal amount (initial investment)

- r = annual interest rate (decimal)

- n = number of times interest is compounded per year

- t = number of years the money is invested or borrowed for

Let’s break this down with real-world examples.

How It Works in Real Life

Example 1: Simple vs. Compound Interest

Let’s say you invest $1,000 at an interest rate of 5% annually for 10 years.

- With simple interest, you earn $50 per year:

$50 x 10 = $500 in interest

Total = $1,500 - With compound interest (compounded annually):

Your money grows to $1,628.89

You earn $628.89 in interest

That’s $128.89 more just by letting the interest compound.

Example 2: Starting Early Pays Off

If you invest $2,000 per year at 8% annual return starting at age 20 and stop at age 30, your total investment will be $20,000.

But by age 60, that money grows to over $300,000 — without adding another penny.

Compare that to someone who starts investing $2,000 per year at age 30 and keeps going until 60. They invest $60,000 total, but end up with around $250,000.

Starting early is more powerful than investing more later.

Factors That Affect Compound Growth

1. Time

The longer your money compounds, the more dramatic the growth. Even a small amount can turn into a large sum over decades. That’s why time is your best friend when investing.

2. Interest Rate

Higher rates mean faster growth. Choosing investments with a reasonable return can make a big difference, even if the difference in rate seems small.

3. Frequency of Compounding

Interest compounded more frequently (monthly vs. annually) accelerates your growth. Some savings accounts compound daily, which adds up over time.

4. Additional Contributions

Regularly adding money boosts your returns significantly. It’s like giving compound interest more material to work with.

Where You’ll See Compound Interest in Action

Savings Accounts

Most high-yield savings accounts compound interest daily or monthly. While rates are modest, the effect is still beneficial.

Investment Accounts

Stocks, mutual funds, and index funds benefit from reinvested dividends and capital gains, compounding your growth over time.

Retirement Accounts

401(k)s and IRAs benefit from tax advantages and long-term compounding. Starting early can result in a huge difference in retirement savings.

Debt (The Other Side)

Compound interest works against you in credit card debt. If you don’t pay your balance in full, the interest is compounded, making the debt grow rapidly.

Tips to Make Compound Interest Work for You

- Start early — even if it’s with small amounts

- Invest regularly — set up automatic deposits

- Avoid unnecessary debt — especially with high-interest rates

- Be patient — compounding takes time, but it’s powerful

- Reinvest earnings — don’t withdraw dividends or interest

Tools That Help You Calculate It

Use free compound interest calculators online to visualize your goals. Try tools from:

- Investor.gov (U.S. SEC)

- NerdWallet

- Bankrate

- Personal finance apps like Mint or YNAB

These help you run scenarios and see how different interest rates or timelines affect your future balance.

The Power of Compound Interest Is in Your Hands

You don’t need to be rich to take advantage of compound interest. You just need time, consistency, and a plan. Whether you’re saving $10 a week or investing hundreds a month, the earlier you begin, the more compound interest will reward you.

It’s not about making massive investments — it’s about staying consistent and letting time do the heavy lifting. Start today, even with a small amount, and let compound interest become your silent financial partner for life.