Many young adults enter adulthood without knowing how to manage their finances. Between credit cards, student loans, rent, and the temptation to spend, navigating money can feel overwhelming. But learning basic financial skills early in life can set the stage for long-term security and independence. Here’s how to start building a solid financial foundation — even if you’re completely new to the subject.

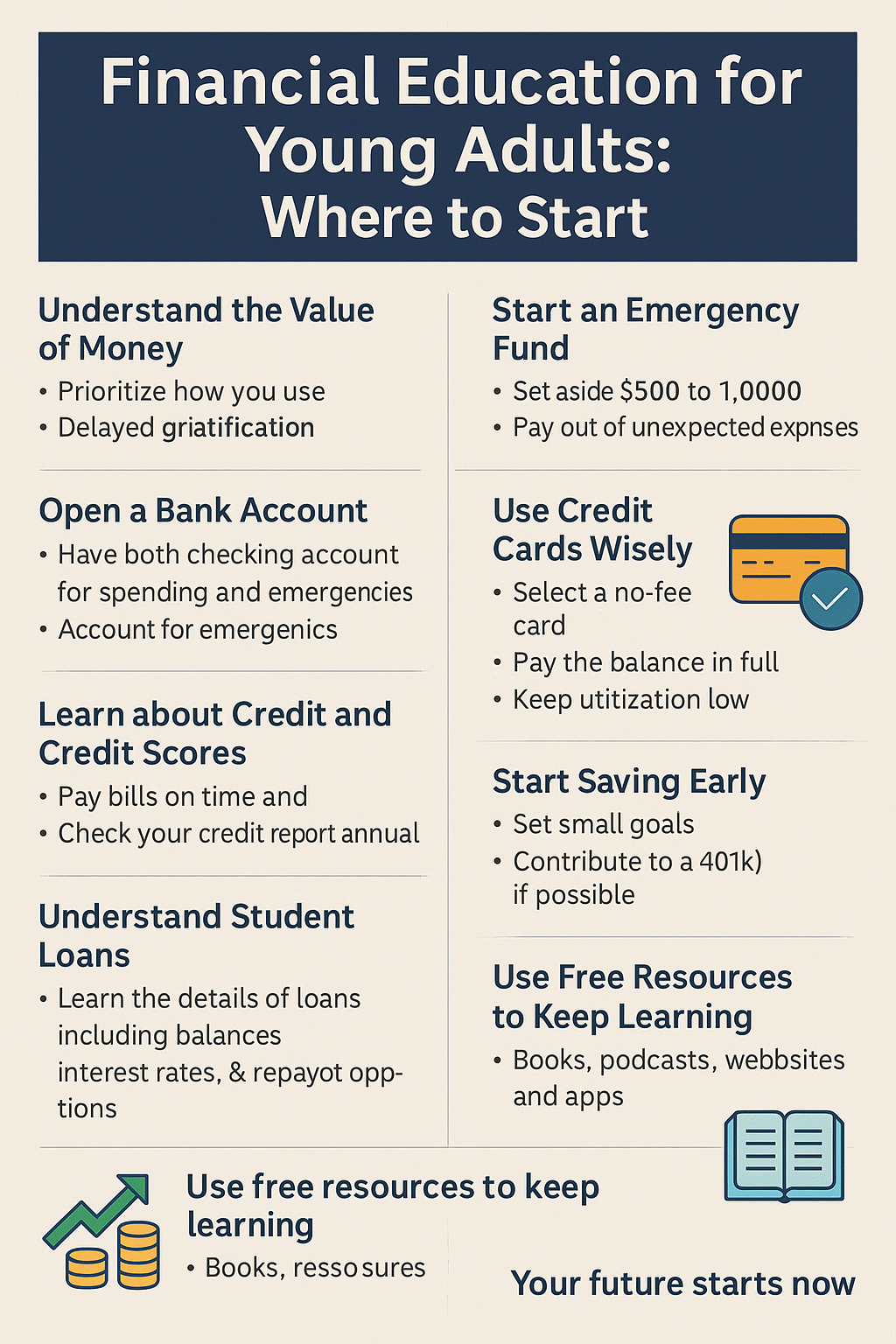

Understand the Value of Money

Money isn’t just about buying things. It’s a tool for freedom, choices, and building the life you want. Before diving into budgets and savings, develop the right mindset:

- Money is limited: prioritize how you use it.

- Every dollar has a purpose: either to spend, save, invest, or give.

- Delayed gratification builds long-term wealth.

Recognizing the value of each dollar helps you become more intentional and confident with your decisions.

Learn How to Budget

Budgeting isn’t about saying “no” to fun — it’s about knowing your limits and making room for what matters.

Start with the 50/30/20 rule:

- 50% for needs (rent, groceries, bills)

- 30% for wants (dining out, shopping, hobbies)

- 20% for savings and debt repayment

Use simple tools like Google Sheets, Mint, or Goodbudget to track your income and expenses. Review your budget every month and make adjustments based on what’s working.

Open a Bank Account

If you haven’t already, opening a bank account is the first practical step toward managing money. You’ll need:

- A checking account for everyday spending and bill payments

- A savings account for building an emergency fund

Choose a bank with no monthly fees, easy mobile access, and solid customer service. Learn how to use online banking to transfer funds, track spending, and pay bills.

Start an Emergency Fund

Life is unpredictable. An emergency fund gives you a cushion when things go wrong — car repairs, unexpected travel, or a job loss.

Start small: aim for $500 to $1,000 in a separate savings account. Add to it each month, even if it’s just $25. This is your financial safety net, and it’s one of the most important tools in your financial toolkit.

Learn About Credit and Credit Scores

Your credit score will affect your ability to rent apartments, get loans, or even apply for jobs. Knowing how it works helps you protect and build it from the start.

Basic credit-building tips:

- Pay your bills on time — always

- Keep credit card balances low

- Don’t open multiple accounts at once

- Check your credit report annually (free at AnnualCreditReport.com)

Using credit responsibly early on sets the tone for your financial life.

Use Credit Cards Wisely

Credit cards aren’t free money. They’re useful tools — if used correctly. As a beginner, choose a no-annual-fee card and keep spending low.

Best practices:

- Pay your balance in full every month

- Never use more than 30% of your available credit

- Avoid cash advances

- Set up payment reminders

Building a healthy credit history early gives you access to better financial options later.

Understand Student Loans

Many young adults carry student loan debt, but few truly understand how repayment works. Know the details of your loans:

- How much you owe

- Your interest rates

- Monthly payments and due dates

- Options for deferment or income-based repayment

Avoid missing payments and make extra contributions when possible to reduce interest over time.

Start Saving Early

Even if you’re not earning a lot, saving small amounts builds strong habits. Create short-term goals (like travel or a new laptop) and long-term ones (like retirement or a house).

Set up automatic transfers to your savings account. As your income grows, increase the amount gradually. If your job offers a retirement plan like a 401(k), contribute as soon as possible — especially if your employer matches.

Learn the Basics of Investing

You don’t need to be a stock market expert to get started. Investing is about growing your money over time and beating inflation.

Start by learning:

- The difference between stocks, bonds, and mutual funds

- What compound interest is and why it matters

- How to invest in index funds or ETFs

- The risks and rewards of different asset types

Begin with small investments and prioritize consistency over timing the market.

Avoid Financial Pitfalls

Common mistakes young adults make:

- Spending more than they earn

- Ignoring debt

- Relying on credit cards to fund their lifestyle

- Not saving for emergencies

- Failing to track expenses

Financial independence isn’t about being rich — it’s about control and choices. The earlier you learn these habits, the easier they become.

Use Free Resources to Keep Learning

There’s no shortage of tools to help you improve your financial literacy:

- Books: “The Psychology of Money,” “I Will Teach You to Be Rich,” “Your Money or Your Life”

- Podcasts: “How to Money,” “Money Guy Show,” “Planet Money”

- Apps: Mint, NerdWallet, Investopedia

- Websites: MyMoney.gov, Smart About Money, The Financial Diet

The more you learn, the better your decisions will be.

Your Future Starts Now

Taking control of your finances in your teens or twenties is one of the most valuable things you can do. You’ll avoid stress, build security, and have more freedom to live on your own terms. Financial education isn’t about being perfect — it’s about being prepared. Learn a little more each day, apply what you learn, and watch your confidence grow.