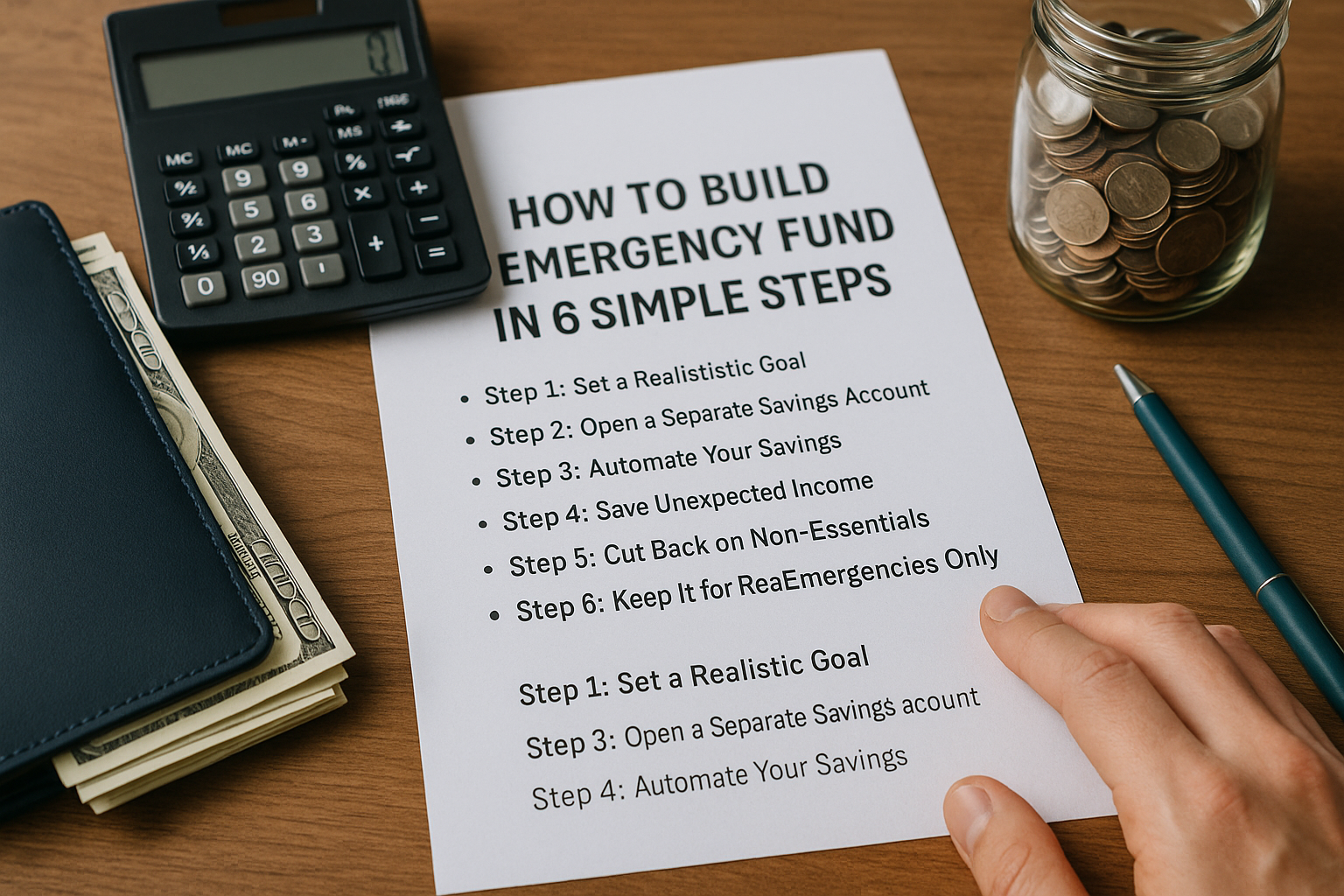

Life is full of surprises — some exciting, others expensive. Whether it’s a medical bill, job loss, or unexpected home repair, an emergency fund acts as a financial safety net. For beginners, building this fund may seem overwhelming, but with the right approach, anyone can create one. Here’s how to build an emergency fund in six simple, practical steps.

What Is an Emergency Fund?

An emergency fund is a stash of money set aside to cover sudden, unplanned expenses. It prevents you from going into debt when life throws a curveball. Ideally, it should be easily accessible and stored in a secure, low-risk account, such as a high-yield savings account.

Why You Need One

- Avoid debt during financial emergencies

- Gain peace of mind

- Protect your long-term savings and investments

- Make better financial decisions under stress

Step 1: Set a Realistic Goal

A fully funded emergency fund usually equals three to six months of living expenses. But don’t worry if that sounds like too much right now.

Start Small

Set a short-term goal, like $500 or $1,000, to get started. This will cover common emergencies like car repairs or medical bills.

Know Your Monthly Expenses

To set the full target, list your monthly needs: rent, utilities, groceries, insurance, transportation. Multiply that by 3 or 6 to find your ideal emergency fund size.

Step 2: Open a Separate Savings Account

Keep your emergency money separate from your everyday checking account to avoid accidental spending. Look for:

- High-yield savings accounts (online banks often offer better rates)

- No monthly fees

- Easy online access

- FDIC-insured for safety

Avoid investing this money — emergency funds must be liquid and low-risk.

Step 3: Automate Your Savings

The easiest way to save is to make it automatic. Set up an automatic transfer from your main account to your emergency fund after each paycheck.

How Much to Transfer?

Even $20 or $50 a week adds up. The goal is consistency, not perfection. Automating eliminates the temptation to spend the money elsewhere.

Step 4: Save Unexpected Income

Put any extra or surprise income directly into your emergency fund. This includes:

- Tax refunds

- Bonuses

- Birthday or holiday cash

- Side gig earnings

- Rebates or cash-back rewards

This fast-tracks your savings without impacting your regular budget.

Step 5: Cut Back on Non-Essentials

Freeing up extra cash for your emergency fund doesn’t mean living miserably. A few strategic adjustments can make a big difference:

- Cancel unused subscriptions

- Cook more meals at home

- Use public transportation or carpool

- Avoid impulse buys — use a 24-hour rule

Even cutting $100 in spending monthly can mean $1,200 saved in a year.

Step 6: Keep It for Real Emergencies Only

Once your emergency fund starts growing, protect it! Use it only for true emergencies, such as:

- Job loss

- Urgent home or car repairs

- Medical emergencies

- Unexpected travel for family crises

Avoid dipping into it for vacations, sales, or non-essential expenses.

Maintaining and Growing Your Fund

After reaching your target, continue contributing lightly — emergencies can be more expensive than expected.

Reassess Annually

As your expenses grow (e.g., new apartment, baby, car), your emergency fund should grow too. Recalculate yearly to stay prepared.

Refill After Use

If you ever withdraw from it, make rebuilding a priority. Go back to smaller goals and automatic transfers until you’re fully protected again.

A Cushion Between You and Financial Stress

An emergency fund is one of the most powerful tools in personal finance. It gives you confidence, stability, and flexibility — especially during tough times. Even if you start with just a few dollars a week, what matters most is building the habit. Over time, those small efforts will create a strong financial cushion between you and life’s unpredictability.