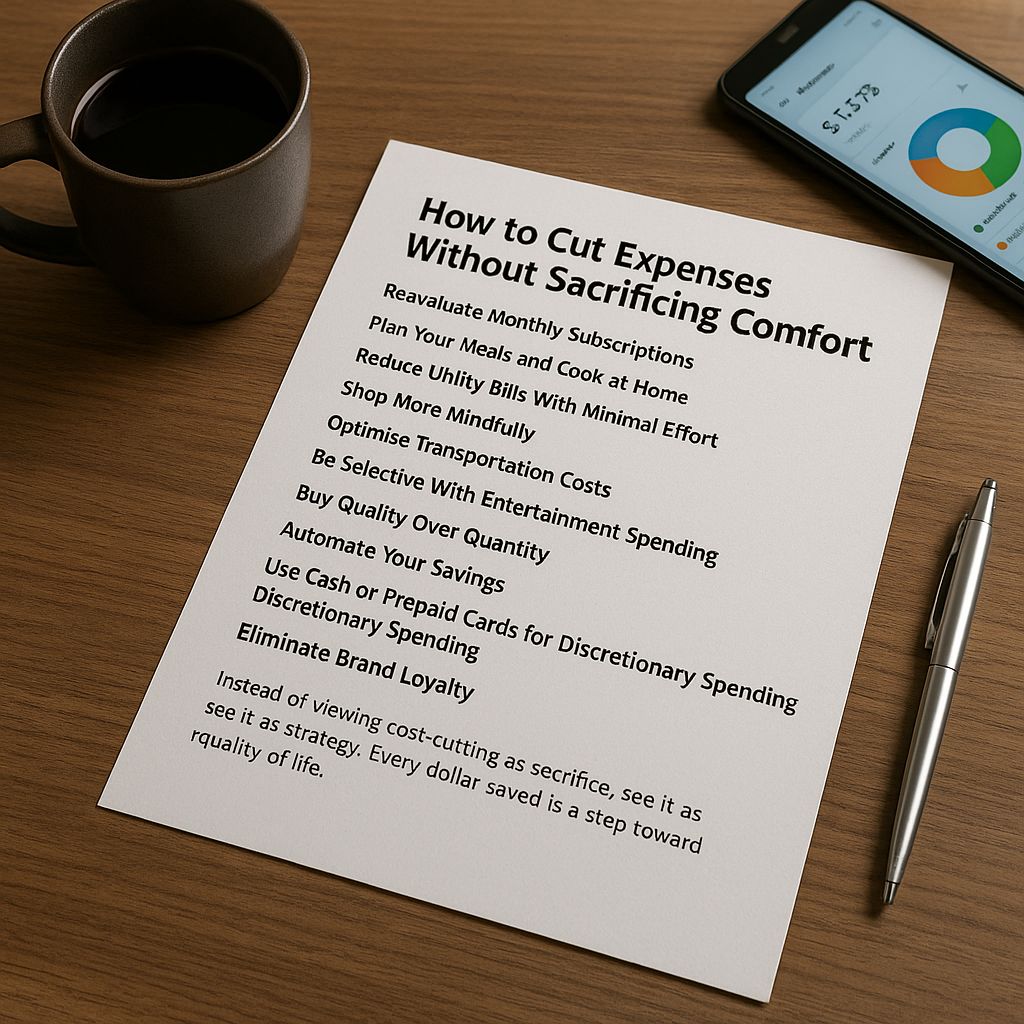

Saving money doesn’t mean you have to give up everything you enjoy. In fact, the most effective financial strategies often come from small, smart changes that reduce spending without affecting your quality of life. Whether you’re trying to build an emergency fund, pay off debt, or simply stretch your paycheck a bit further, here are proven ways to cut expenses while still living comfortably.

Reevaluate Monthly Subscriptions

Automatic subscriptions are convenient, but many people pay for services they no longer use or need. It’s easy to forget about that second streaming platform or an unused gym membership.

Start by reviewing your bank and credit card statements from the past three months. Identify recurring charges and ask yourself whether you still use or value each service. Cancel anything that doesn’t serve your current lifestyle. You can always resubscribe later if needed. Sharing subscriptions with family or friends (when allowed) is another great way to cut costs without losing access.

Plan Your Meals and Cook at Home

One of the most effective ways to reduce expenses is to eat more meals at home. Dining out and ordering takeout can add up quickly. Fortunately, cooking at home doesn’t have to mean boring food.

Plan weekly meals ahead of time and create a shopping list before you head to the grocery store. Stick to your list to avoid impulse buys. Cooking in batches can save both time and money — freeze leftovers for busy nights. Choose recipes you enjoy and make meals feel special with simple touches like a nice drink or music during dinner. You’ll save money and enjoy more control over your health.

Reduce Utility Bills With Minimal Effort

Lowering your energy and water usage doesn’t require dramatic changes. Simple actions can lead to lower bills without compromising comfort.

Use energy-efficient light bulbs like LEDs. Turn off lights and electronics when they’re not in use. Lower the thermostat a few degrees in winter or raise it slightly in summer. Use cold water for laundry and take shorter showers. Seal windows and doors to prevent drafts. These small adjustments reduce your utility bills gradually while keeping your home just as cozy.

Shop More Mindfully

Buying with intention is key to financial comfort. Before making any purchase — especially big ones — ask yourself if it aligns with your priorities and goals. Do you need it now? Can you find it cheaper elsewhere? Is it a want or a need?

Delay impulse purchases with a 24-hour or 7-day rule. Often, the urge to buy fades, and you can avoid spending unnecessarily. Compare prices online, use coupons or cashback extensions, and shop during sales. This applies to everything from clothing to electronics.

Optimize Transportation Costs

Transportation is often a major expense, especially if you drive frequently. Look for opportunities to cut back without giving up convenience.

Combine errands into one trip to save fuel. Consider carpooling to work or taking public transportation if available. Walk or bike for shorter trips — it’s free and good for your health. Maintain your vehicle regularly to avoid costly repairs. If your car insurance hasn’t been reviewed in a while, shop around for a better rate.

Be Selective With Entertainment Spending

Entertainment is important, but it doesn’t need to be expensive. There are countless ways to have fun without overspending.

Explore free community events, museums with no admission days, or outdoor concerts. Host movie nights or potlucks with friends instead of going out. Take advantage of your local library — many offer free access to movies, audiobooks, and digital courses. Being creative with entertainment options can make your social life more meaningful and affordable.

Buy Quality Over Quantity

Spending less doesn’t always mean choosing the cheapest option. In many cases, investing in quality saves money in the long run. A $100 pair of durable shoes that lasts five years is more cost-effective than buying a $30 pair that wears out every few months.

This mindset applies to clothing, electronics, appliances, and even furniture. Focus on purchasing fewer items that are better made and longer lasting. You’ll not only save money over time but also reduce clutter and make your life simpler.

Automate Your Savings

One of the best ways to make room in your budget is to automate savings. Set up a recurring transfer from your checking account to a savings account each month — even a small amount like $20 can make a difference.

Treat savings like a non-negotiable expense. Automating it removes the temptation to spend the money and helps you build financial security painlessly. Over time, those consistent deposits can grow into an emergency fund, travel fund, or something even bigger.

Use Cash or Prepaid Cards for Discretionary Spending

Limiting yourself to physical cash for certain spending categories can help you stay within your budget. It creates a natural boundary that’s harder to cross compared to swiping a card.

Withdraw cash for things like dining out, entertainment, or coffee. Once it’s gone, that’s it for the month. Alternatively, use a prepaid debit card with a set limit to achieve the same effect without carrying cash.

Eliminate Brand Loyalty

It’s easy to stick to familiar brands out of habit, but store brands and generics often offer the same quality at a fraction of the price. This is true for groceries, household products, medication, and even clothing.

Try switching one or two items on your next shopping trip and compare the results. Over time, making these small changes can reduce your monthly expenses without affecting your satisfaction.

Focus on Long-Term Gains

The goal of cutting expenses isn’t just to spend less — it’s to make room for what matters. Whether it’s financial freedom, travel, early retirement, or peace of mind, the money you save today brings you closer to tomorrow’s goals.

Instead of viewing cost-cutting as sacrifice, see it as strategy. Every dollar saved is a step toward greater control, less stress, and a better quality of life. Choose comfort with purpose — and spend smarter, not harder.