Organizing your personal finances might seem challenging, especially if you’re just beginning. However, with proper planning and some simple strategies, it’s possible to build a solid foundation for your financial life, achieve significant goals, and live more peacefully.

This article offers a practical guide for those who wish to start today and gain better control over their money, providing concrete steps to organize your finances, save money, and start investing safely.

Understand Your Current Situation

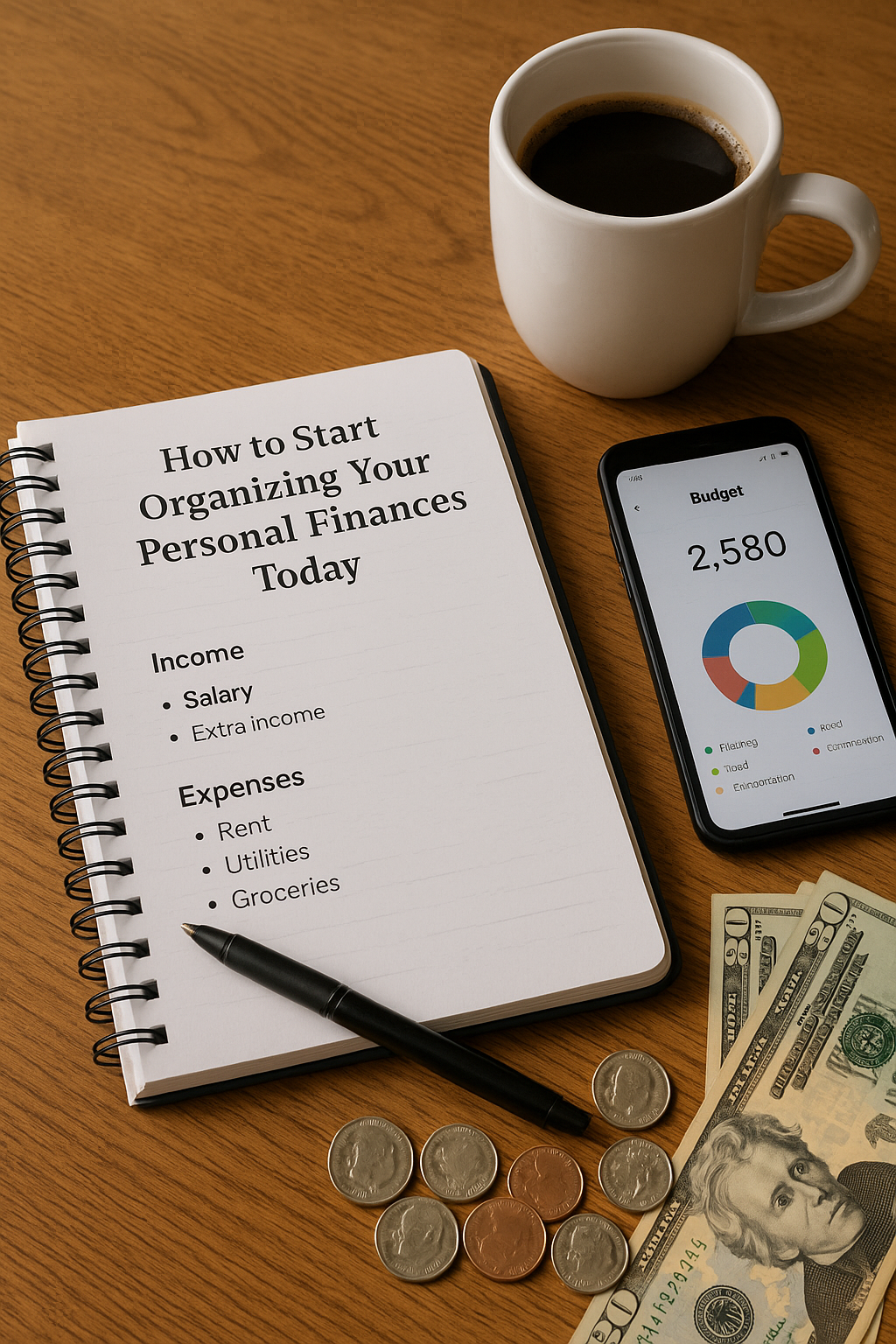

Before initiating any planning, you need a clear understanding of your current financial situation. To do this:

- List all your income: salary, extra earnings, etc.

- List all your expenses: fixed (rent, electricity, water) and variable (food, entertainment)

- Identify your debts, if any, noting interest rates and deadlines

This step might seem straightforward, but it is essential to identify your biggest financial challenges.

Create a Simple and Realistic Budget

A budget is the most powerful tool for managing your finances. To create an effective budget:

- Divide your income and expenses into categories (housing, food, transportation, leisure, etc.)

- Set monthly limits for each category

- Track your spending daily or weekly to ensure you stay within limits

Using apps or spreadsheets can make the process much easier and more efficient.

Start by Saving Small Amounts

Saving doesn’t mean cutting out everything enjoyable, but managing your resources better. Start with small, achievable goals, like saving 5% to 10% of your monthly income.

- Review subscriptions and plans you no longer use

- Reduce expenses on eating out

- Take advantage of promotions and discounts moderately

Over time, you’ll see how small savings accumulate into significant amounts.

Build an Emergency Fund

An emergency fund is a priority for any solid financial plan. It protects you against unexpected events and avoids costly loans.

Ideally, accumulate enough to cover 3 to 6 months of expenses in easily accessible accounts, such as high-yield digital savings or basic money-market funds.

Start small but start immediately, regularly setting aside small amounts into this reserve.

Understand Basic Investing

Investing can initially seem complicated, but understanding the basics is easier than you think. Essential points to start include:

- Learn about compound interest and how it multiplies your money over time

- Familiarize yourself with basic investment options like Treasury Bonds, Certificates of Deposit (CDs), money-market funds, and real estate funds

- Clearly define your investment goals and timeframes. Short-term goals typically require more conservative investments

Starting early and understanding the basics helps avoid common mistakes and steadily grow your wealth safely.

Avoid Unnecessary Debt

One of the most significant financial mistakes is accumulating non-essential debt. Learn to differentiate good debts (those funding your financial growth, like home loans or educational courses) from bad debts (high-interest, unnecessary spending).

- Use credit cards responsibly, always paying the full statement balance

- Opt for upfront payments whenever possible to secure discounts

- Avoid loans for non-return items like clothing or electronics

Use Financial Management Apps

Apps significantly simplify financial management. Popular apps include:

- Mobills

- GuiaBolso

- Organizze

- Minhas Economias

These tools help you record expenses quickly, check statements, and clearly visualize your spending.

Conduct Monthly Progress Reviews

Creating a budget alone isn’t enough; regular reviews are necessary. Each month:

- Assess if your goals are being met

- Adjust if you see something isn’t working

- Celebrate small achievements, such as reducing expenses or meeting savings targets

Regular reviews ensure continuous control and motivation.

Share Your Financial Goals with Someone Close

Sharing your financial objectives with someone trustworthy, like a friend or family member, increases accountability and success chances. This person can help you stay focused, celebrate achievements, and offer support during challenging times.

Be Patient and Consistent

Finally, remember that financial organization is a long-term journey. There are no magic formulas or shortcuts, but patience and consistency will completely transform your financial life.

Organizing your finances is an investment worth every minute. Start right now and discover how small changes can lead to major accomplishments.