Managing your personal finances doesn’t require complicated software or financial expertise. Sometimes, all you need is a simple spreadsheet. Tracking your expenses with a spreadsheet helps you understand where your money is going and how to make better decisions with it. In this guide, we’ll walk you through how to use spreadsheets to track your expenses effectively — even if you’ve never opened Excel or Google Sheets before.

Why Track Your Expenses?

Before diving into the “how,” it’s important to understand the “why.” Tracking expenses provides:

- Awareness: Know where your money is actually going.

- Control: Identify areas of overspending.

- Clarity: Spot patterns and improve planning.

- Progress: See how you’re doing with financial goals.

A spreadsheet turns your day-to-day purchases into actionable insights.

Choose Your Tool: Excel, Google Sheets, or Other Options

You don’t need to spend money on financial software. Free tools work great for most people.

Google Sheets

- Free and accessible from any device.

- Easy to share and collaborate.

- Automatically saves changes in the cloud.

Microsoft Excel

- Ideal for users who prefer offline work.

- Offers more advanced functions if needed.

Pick whichever tool you’re more comfortable with — both are powerful for expense tracking.

Set Up Your Spreadsheet

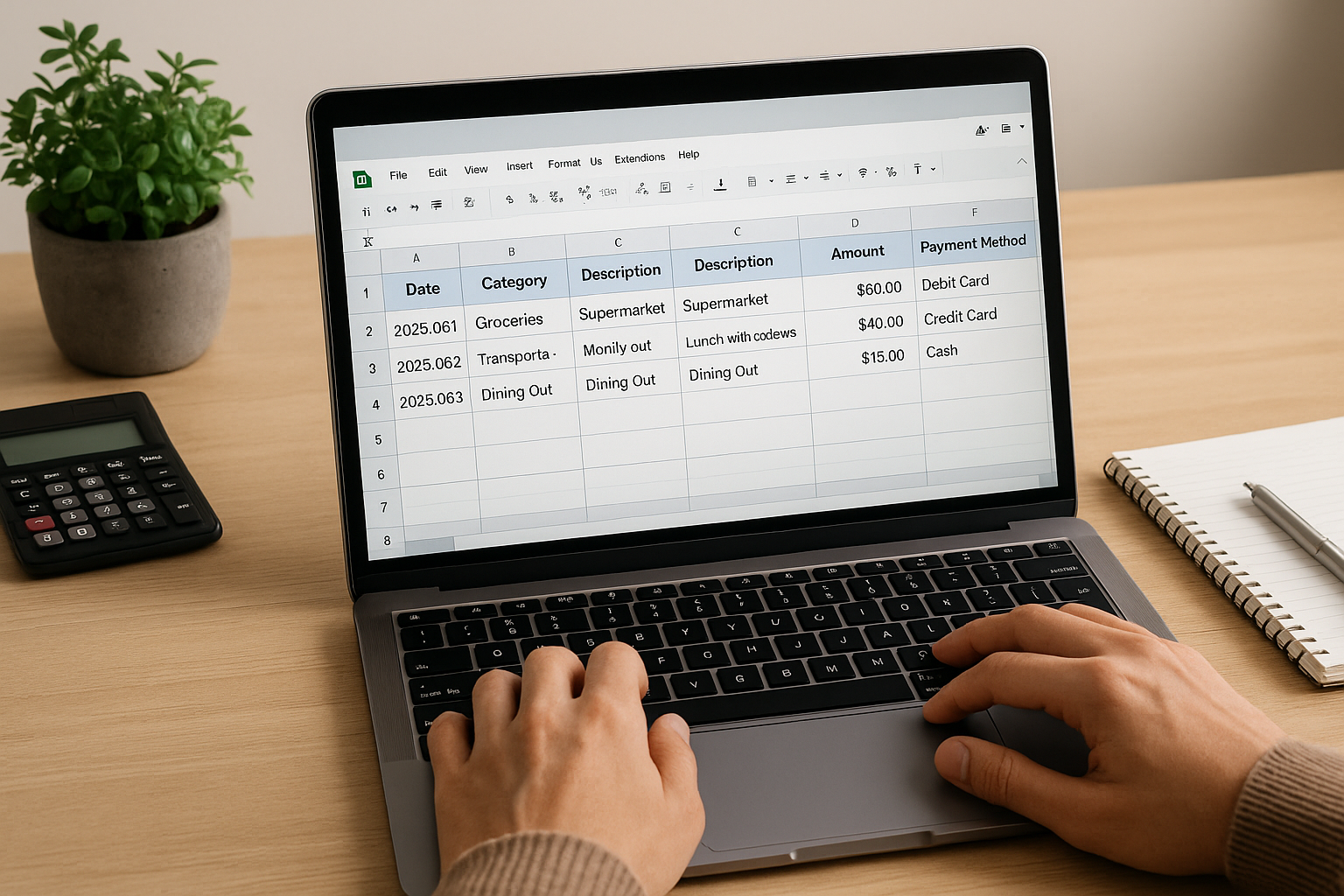

Let’s walk through setting up a basic expense tracker.

Step 1: Create Columns

Start by setting up the following columns:

- Date – When you made the expense.

- Category – Food, rent, utilities, entertainment, etc.

- Description – What the expense was.

- Amount – How much it cost.

- Payment Method – Cash, credit card, debit, etc.

Here’s how it looks in the first few rows:

| Date | Category | Description | Amount | Payment Method |

|---|---|---|---|---|

| 2025-06-01 | Groceries | Supermarket | $60.00 | Debit Card |

| 2025-06-02 | Transportation | Monthly Bus Pass | $45.00 | Credit Card |

| 2025-06-03 | Dining Out | Lunch with coworkers | $15.00 | Cash |

Step 2: Format Your Sheet

Use the formatting features to:

- Make the “Amount” column currency.

- Freeze the top row so your headers stay visible.

- Use bold or color to make headings stand out.

Categorize Your Spending

Categorization is what transforms a raw list of expenses into useful data. Create a list of categories that reflect your lifestyle, such as:

- Rent or Mortgage

- Utilities

- Food (Groceries & Dining Out)

- Transportation

- Entertainment

- Subscriptions

- Savings

- Health

Keep the number of categories manageable to avoid clutter.

Use Basic Formulas

Spreadsheets become even more useful when you add simple formulas:

=SUM(D2:D100)– Adds up all expenses in the “Amount” column.=AVERAGE(D2:D100)– Gives your average daily spending.- Use

=IFfunctions to flag expenses over a certain amount. - Apply filters to view spending by date, category, or payment method.

Optional: Add Charts

Visual learners benefit from pie charts or bar graphs. Use charts to see:

- Percentage of spending per category

- Spending over time

- How your income compares to expenses

Both Google Sheets and Excel have built-in chart tools that are easy to use.

Track Income Too

To get the full picture, include income rows in your spreadsheet. You can either:

- Add a second sheet labeled “Income”

- Add an “Income” category in your main sheet

Then subtract total expenses from total income to see your monthly balance.

Review Your Spending Weekly

Consistency matters. Schedule 10–15 minutes once a week to:

- Log new expenses

- Categorize them

- Check totals vs your budget

- Adjust upcoming spending if needed

If you skip this step, the spreadsheet becomes just another forgotten document.

Keep a Running Monthly Total

At the end of each month, summarize:

- Total income

- Total expenses

- Net gain or loss

- Category breakdown

Copy these numbers into a new sheet labeled “Monthly Summary” for long-term tracking.

Spreadsheet Tracking: Simple Yet Powerful

Using a spreadsheet to track your expenses is one of the simplest — and most effective — ways to manage your finances. It’s free, customizable, and easy to update. Once it becomes part of your routine, you’ll gain full control over your spending and feel more confident with your money.

You don’t need to be an Excel wizard to make this work. Start small, stay consistent, and let your spreadsheet become your financial mirror — reflecting habits, highlighting opportunities, and showing progress.