A zero-based budget is one of the most powerful and intentional ways to take control of your money. Unlike traditional budgeting methods that focus on spending limits by category, zero-based budgeting gives every dollar a purpose—down to the last cent.

If you’ve ever felt like your money disappears each month without knowing exactly where it went, this method could be the solution you’ve been looking for.

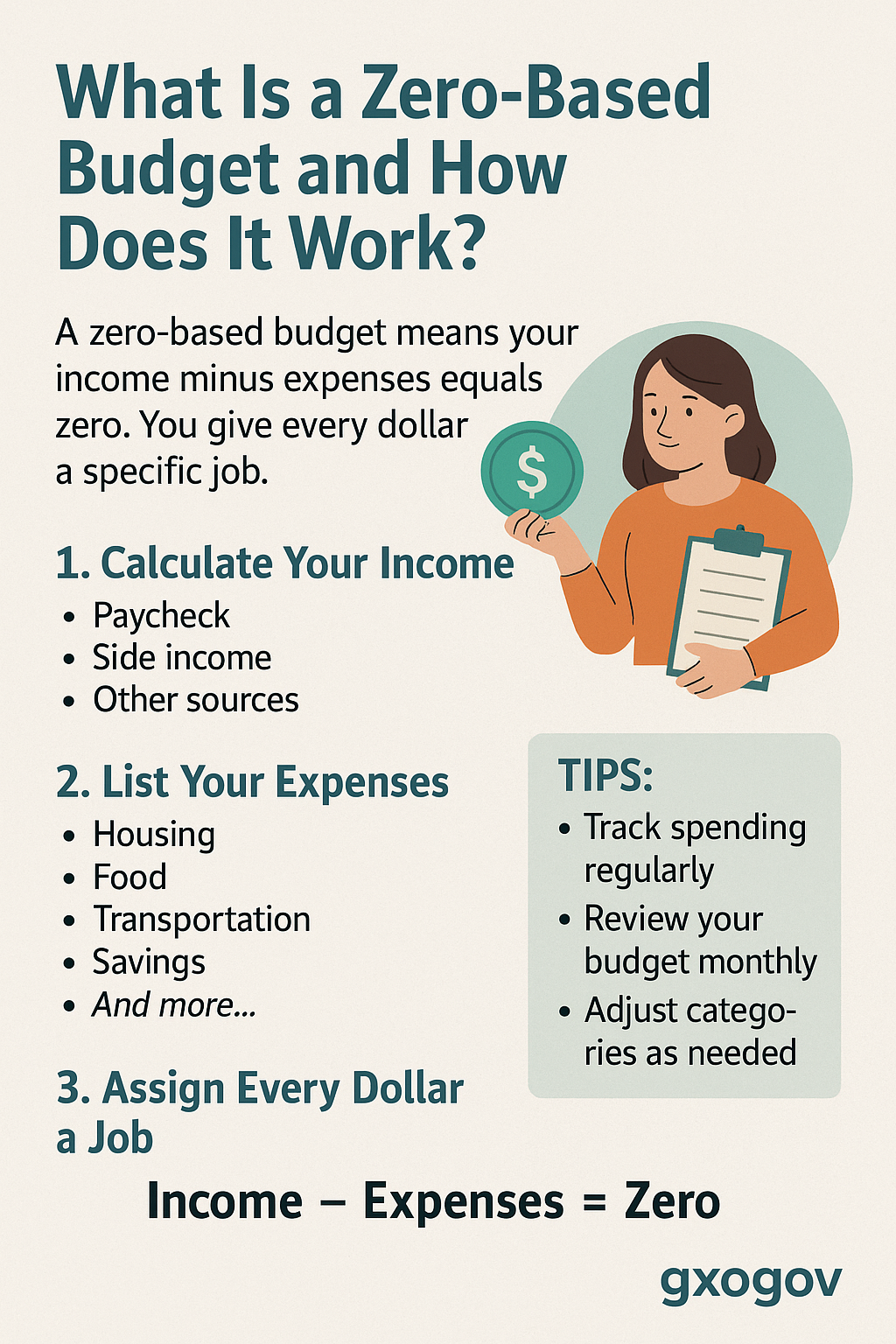

What Is a Zero-Based Budget?

A zero-based budget means that your income minus your expenses equals zero. That doesn’t mean you spend all your money. Instead, it means you assign every dollar a job—whether it’s spending, saving, investing, or paying off debt.

For example, if you earn $3,000 this month, you’ll plan exactly how to allocate all $3,000:

- $1,200 to rent

- $300 to groceries

- $200 to utilities

- $150 to savings

- $100 to extra debt payment

- $50 to fun or dining out

- And so on… until every dollar is accounted for

At the end, your budget “balances out” to zero—no money left unassigned, no money forgotten.

Why It Works

The biggest benefit of a zero-based budget is intentionality. You’re not just hoping you spend less—you’re planning every dollar in advance.

This method helps you:

- Avoid overspending

- Track where your money goes

- Save more consistently

- Pay off debt faster

- Feel in control of your finances

It turns your budget from a passive record into an active tool.

Who Should Use a Zero-Based Budget?

A zero-based budget works well for:

- Beginners who need structure

- People trying to pay off debt

- Anyone living paycheck to paycheck

- Households with inconsistent income

- Those who want to increase savings

If you’re tired of “guessing” your way through your finances each month, this method creates clarity and purpose.

How to Create a Zero-Based Budget Step by Step

1. Calculate Your Total Income

Add up all sources of income you expect for the month:

- Salary (after tax)

- Side hustle income

- Government benefits

- Child support or alimony

- Freelance work

Use conservative estimates if your income fluctuates.

2. List All Your Expenses

Write down every category where you spend money:

- Housing

- Food

- Utilities

- Transportation

- Insurance

- Minimum debt payments

- Subscriptions

- Savings

- Emergency fund

- Personal spending

- Entertainment

Be honest. Don’t leave anything out, even irregular expenses.

3. Assign a Job to Every Dollar

Match your income to your expenses. Start with essentials (needs), then move to savings and debt, and finally to non-essentials (wants).

Adjust categories until the total equals your exact income for the month.

4. Track Spending Throughout the Month

This step is key. As you spend money, subtract from each category to stay within your plan.

Use apps like YNAB, EveryDollar, or a spreadsheet to monitor your progress in real time.

5. Review and Adjust Monthly

Your budget will change month to month depending on your income, bills, and goals.

At the start of each month:

- Update income totals

- Adjust expenses

- Reassign any leftover money or windfalls

Zero-based budgeting is flexible—it grows with your life.

Tips for Success

- Use separate bank accounts for bills, spending, and savings if it helps you stay organized.

- Set reminders to review your budget weekly.

- Don’t forget irregular costs like birthdays, back-to-school supplies, or holidays.

- Give yourself grace. You’ll get better with each month of practice.

Common Mistakes to Avoid

- Not budgeting for savings: Treat savings like a fixed bill.

- Leaving categories out: Missed expenses lead to blown budgets.

- Forgetting to track: Planning is useless if you don’t follow through.

- Quitting after one mistake: Adjust and try again next month.

Conclusion: Take Charge of Every Dollar

A zero-based budget gives you total control over your money. By assigning every dollar a purpose, you eliminate guesswork, avoid waste, and make progress faster toward your financial goals.

Whether you’re saving, paying off debt, or just trying to stop the money leaks, this method helps you stay focused and intentional.